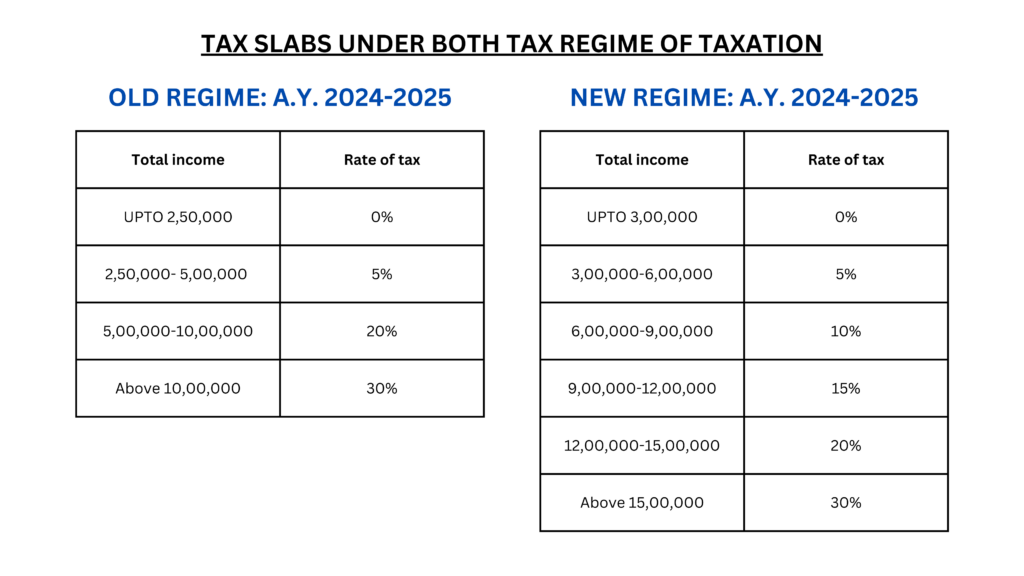

The tax system that existed before the implementation of the new regime

is the old tax regime. To design an efficient salary structure and pay

minimal tax, employees has an option to choose between the old and new

tax regime every financial year.

Benefits of opting for new tax regime:

- If Employees are having a total income up to Rs. 7,50,000/- (after claiming standard deduction of Rs. 50,000/- and rebate u/s 87A of Rs. 25,000) which becomes the tax-free income threshold under the new regime, it makes practical sense for employees earning up to 7.5 lakhs to explore the benefits of the new tax regime where the employees does not have any deductions or allowances available to claim

- Lower surcharge rate is offered under new tax regime i.e. 25% as compare to old tax regime i.e. 37% for income slab of Rs. 5 crores & above.

Deductions/exemptions available under old regime but will not be available in new regime are:

- Interest on home loan (self-owned) [maximum deduction=Rs.2,00,000]

- Professional tax

- House Rent Allowance ( HRA )

- Leave Travel Allowance ( LTA )

- Deduction on health insurance premium u/s 80D

- Deduction u/s 80C

- Employee’s own contributions to NPS account u/s 80CCD(2B)

- Exemptions for free food and beverages through vouchers / food coupons

- Deduction u/s 80TTA interest on deposits in saving account

- Deduction u/s 80TTB interest on deposits with a banking company ( for senior citizens)

- Deduction u/s 80CCH

But what if employees are having a total income of more than 7,50,000/- ?

For employees with an income exceeding Rs. 7.5 lakhs, the decision of which tax regime to opt for requires careful consideration of various factors and would depend upon case to case.

Now, if the total income is more than Rs. 7,50,000/- there are certain allowances and deductions (other than standard deduction and rebate) which are available only in old tax regime and the employee can claim the benefit of the same and increase their breakeven threshold of paying NIL tax.

CONCLUSION:

Both the old and new tax regimes possess advantages and disadvantages. The previous tax structure encourages taxpayers to cultivate a habit of saving, while the new tax structure favors employees with lower earnings and investments, resulting in fewer deductions and exemptions. However, due to the unique nature of individual deductions and exemptions, a thorough comparison of the two regimes is necessary to determine the best fit for each person.

The new income tax regime is designed to accommodate those who prefer minimal deductions or wish to avoid the burden of extensive tax preparation. This includes non-salaried taxpayers, such as consultants, who are not eligible for Section VIA exemptions and deductions. Conversely, senior citizens, who derive a substantial portion of their income from interest, can benefit from the newly introduced Section 80TTB, which

allows them to claim Rs.50,000 as interest income deduction. Therefore, they may feel more secure under the old tax regime.